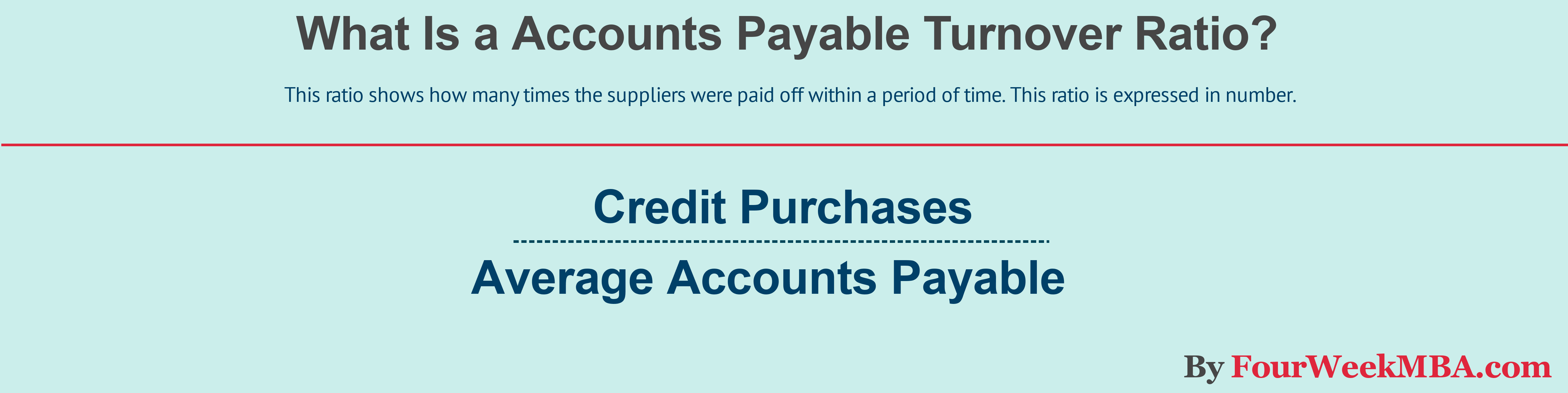

To calculate the accounts payable turnover, two components are necessary: the amount of money the company paid to its suppliers, and the period of time. A high turnover rate is an indicator of a company’s ability to pay its bills on time. It shows how often the company pays or clears its suppliers’ invoices in a given period of time. What are the Components of Accounts Payable Turnover?Īccounts payable turnover is a calculation that measures a company’s short-term liquidity.

Unlocking Potential Capital Growth and Steady Dividend Streams: Invest in Growth and Income Funds Today!.Unlock the Benefits of Automation with Financial Automation-Act Now!.

ACCOUNTS PAYABLE TURNOVER RATIO FULL

Companies who enjoy longer credit periods allowed by creditors usually have low ratio as compared to others.Ī high ratio (prompt payment) is desirable but a company with shortage of cash should avail the full credit period allowed by its suppliers as it would hep the company manage its cash flows. A high ratio means prompt payment to suppliers for the goods purchased on credit and a low ratio may be a sign of delayed payment.Īccounts payable turnover ratio also depends on the credit terms allowed by suppliers. ** / 2 Significance and Interpretation:Īccounts payable turnover ratio indicates the creditworthiness of the company. It means, on average, P&G company pays its creditors 5 times in a year. Required: Compute accounts payable turnover ratio (creditors’ velocity). The following data has been extracted from the financial statements of P&G for the year 20: P&G trading company has good relations with suppliers and makes all the purchases on credit. If opening balance of accounts payable is not given, the closing balance (including notes payable) should be used. But if credit purchases are not known, the total net purchases should be used.Īverage accounts payable are computed by adding opening and closing balances of accounts payable (including notes payable) and dividing by two.

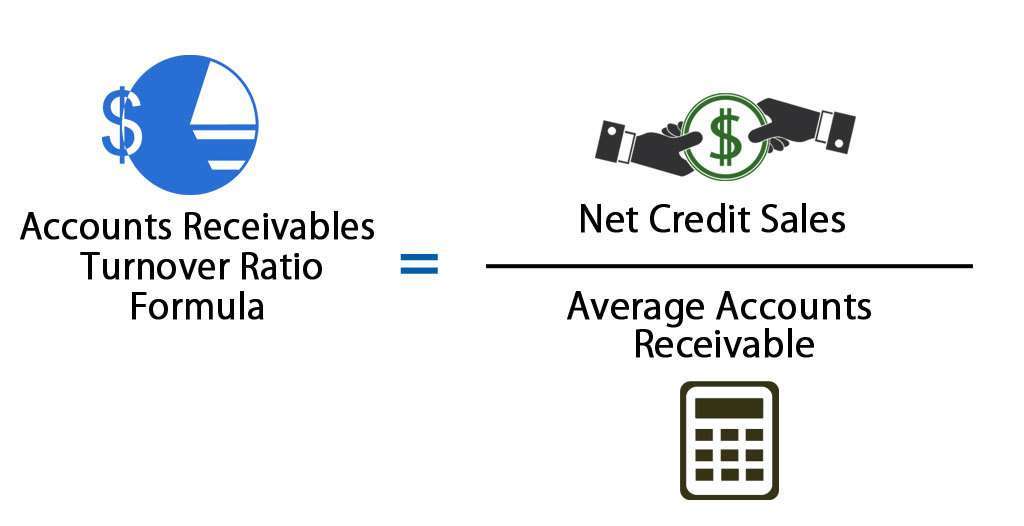

In above formula, numerator includes only credit purchases. Like receivables turnover ratio, it is expressed in times. It measures the number of times, on average, the accounts payable are paid during a period. Accounts payable turnover ratio (also known as creditors turnover ratio or creditors’ velocity) is computed by dividing the net credit purchases by average accounts payable.

0 kommentar(er)

0 kommentar(er)